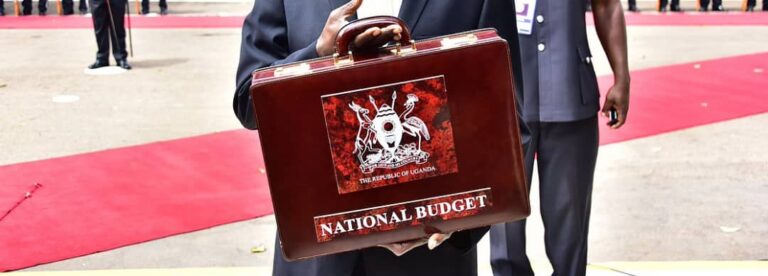

President Museveni yesterday during the budget reading of 72.136Trillion emphasised wiping corruption from his government and cautioned the culprits to be prepared for justice as a re-assurance of accountability, effectiveness and efficiency in service delivery. Uganda was voted best investment nation in Africa according to the annual investment meeting held in Abudhabi and Finance Minister Kasaija accredit it to economy recovery from internal shocks with 6% GDP projected growth compared to 5% financial 2023/2024; higher growth in all sectors, agriculture, services and industries, notable reduction of inflation from 10.7% to 3% as of May 2024 with reduction in interest rate from19% April 2023 to 17.7% 2024.

The 72.136trillion shs. Budget for financial year 2023/2024 priotises several sectors, transport sector 4.989 trillion focusing on road maintenance, railway, tarmac roads e.t.c, 2.946 trillion health sector geared towards regional blood banks, purchase of 116 new ambulances, health centre 3 and 5 upgrades, medicine, wages for medical interns, construction and rehabilitation of more health centres e.t.c, 2.497trillion education to support new curriculum from S1-S4, provide loans to 5,192 degree and 1,125 diploma students e.t.c 1.878Trillion agricultural Industrialisation, 289.6billion tourism, 920.68billion mineral development, 246 billion information technology, 9.566 trillion security, targeting security of persons and property, enhancing military capacity, salary enhancement e.t.c among other sectors.

Hon. Matia Kasaija’s budget strategies are centered towards agro- Ind strialisation, tourism, minerals oil and gas and science, technology development. However for the strategies to be implemented, Ministry of Finance together with National Planning Authority must mitigate climate change, regional and global geopolitical tension and high interest rates that limit borrowing for investment.

Shs.34.3trillion is appropriation and 37.8 trillion is statutory. The budget is to be financed by domestic revenues and other sources and Hon. Kasaija encourages Uganda Revenue Authority to improve revenue collections despite the recent tax wars with traders over EFRIS. Though the budget allocations is viewed developmental, many economists believe it is too opportunistic and will cause a heavy burden on tax payers.

It’s important to note, tax increment on petroleum, kerosene which many believe in the near future may rise inflation on goods and services since transport cost may rise. The question remains, can Uganda Revenue Authority collect the 34.3 trillion shs.? Is it not exegerated considering the tax base?