Uganda Revenue Authority web portal has entered the 2nd day without clients being able to access it.

The decorated revenue portal that was rich with several self-service options such as KAKASA with Efris, Self Service, Career among others has been down since yesterday early morning restricting log in by clients.

This uncertain shutdown left many people wondering whether it was hacked by some anonymous IT genius for reasons yet to be understood.

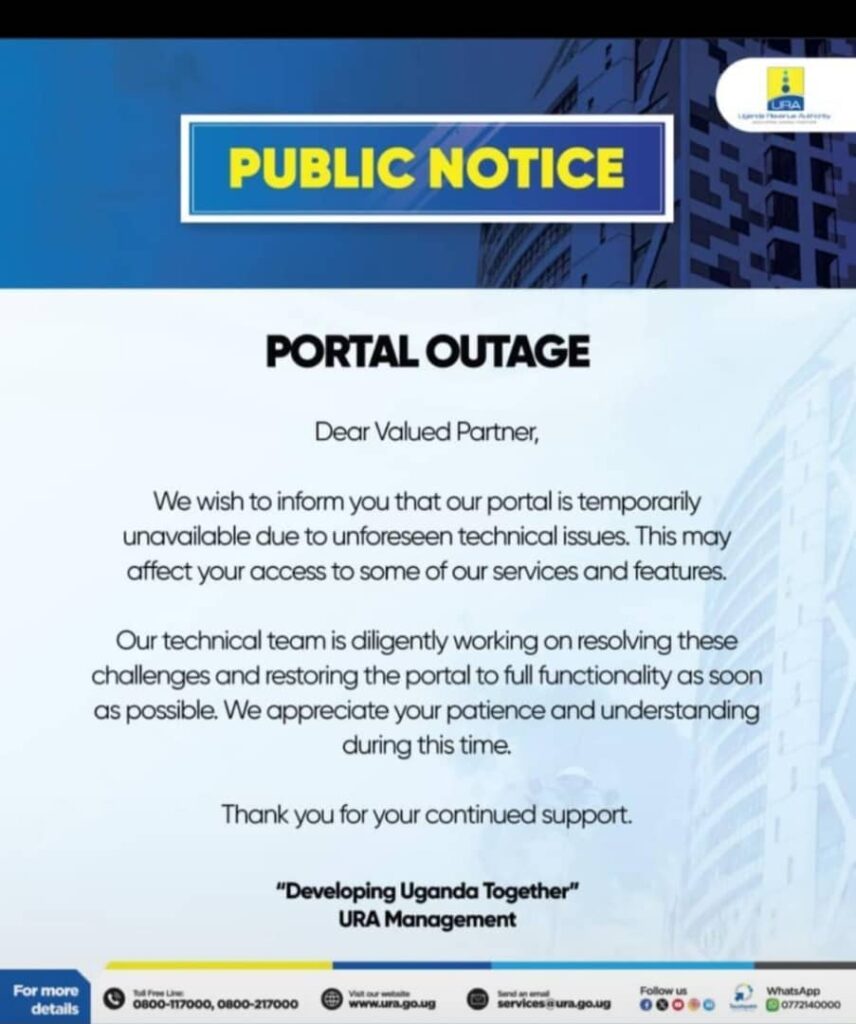

URA later released a public notice that the Campusa Magazine saw claiming that their portal is currently undergoing some technical upgrade and they apologized for the incident.

With this shutdown, several trades have claimed to have lost millions of shillings from their routine events since they are not able to generate fiscalized documents such as EFRIS invoices, credit notes neither can they access URA Touch point among other activities to facilitated compliance with the taxman.

It is very rare for this lucrative highly invested URA website to just go mute for two days unless otherwise. Of recent several amendments have been modified on the portal to ensure user friendliness such as Instant TIN generation which is now a click away compared to the previous process where one was required to first download and fill the template before physically delivering it to any URA offices to obtain a Tax Identification Number (TIN).

“Effective 1st January 2022, URA started issuing instant Tax Identification Numbers (TINs) to individual taxpayers through an upgraded web-based application form. Taxpayers processing TINs to execute temporary transactions will most benefit from this upgrade.

The upgraded web-based application form will only require a valid National Identification Number (NIN) for one to apply for the TIN. For individuals without NINs, a passport or driving permit will suffice. Taxpayers will only fill in three fields, namely, personal information, source of income and address. The use of phone numbers has taken the place of emails to avert the use of duplicate emails.” The Taxman stated.

Among the more features that is expected to be modified includes a VAT prefilled return template that would allow a taxpayer to just auto generate a prefilled return basing on his or her Efris transcatiosn during the month.

Rental income tax is also set to be introduced as a stand alone return away from the previous Income Tax return.

We hope the system upgrade will increase customer